Nội Dung Chính

Status of Real estate credit in Vietnam

According to the State Bank of Vietnam, 94% of real estate loans have a period of 10-25 years, while 80% of bank deposits are short-term deposits with interest rates that vary according to the market. It seems that the lesson of the liquidity risk crisis for the period 2008 – 2011 has not yet quenched the desire of the “big guys” when the real estate credit growth rate has always been the leading in the past 5 years.

Not coincidentally, major international institutions such as the World Bank (WB) and the International Monetary Fund (IMF) have recently recommended that Vietnam need to strictly control risks to the banking system, blood vessels and the banking system. of the economy, amid rising global macro risks.

Both of the above organizations are concerned about the maturity imbalance on the balance sheets of Vietnamese banks. At the same time, it is recommended that the operator take active measures to strengthen the capital adequacy ratio (CAR) of banks to increase resilience.

At the beginning of 2023, when the real estate market and the financial market faced an unprecedented tension due to a series of “bombs” of corporate bonds being ignited. On February 8, 2023, the State Bank held a Real Estate Credit Conference to listen to opinions from more than 20 large real estate enterprises and associations.

At the end of this conference, there were more than 10 groups of issues proposed by enterprises to the State Bank’s leaders, including: (1) clarifying and supplementing regulations on loan purposes; (2) clarify the regulations on the form of disbursement; (3) detailed calculation of real estate loan balance structure to control real estate for business or buyers; (4) rescheduling or deferring debt from 24 to 36 months, at the same time, keeping the same debt group; (5) should not distinguish risk coefficients; (6) the ratio of collateral should not be higher than other areas; (7) develop a capital mechanism for social housing; (8) develop separate mechanisms and policies for industrial park real estate development; (9) develop a circular guiding foreign debt; (10) the loan term is longer than the project implementation period; (11) coordinate with the Ministry of Finance to handle difficulties and obstacles in the corporate bond market; (12) exemption and reduction of fees.

Particularly for social housing, the State Bank has directed commercial banks to deploy a credit program of VND 120,000 billion from the capital of commercial banks with lower lending rates from 1.5 to 2. % average lending interest rate of banks in the market. A large number of apartment for sale to special buyers.

Risks from real estate, bond and banking

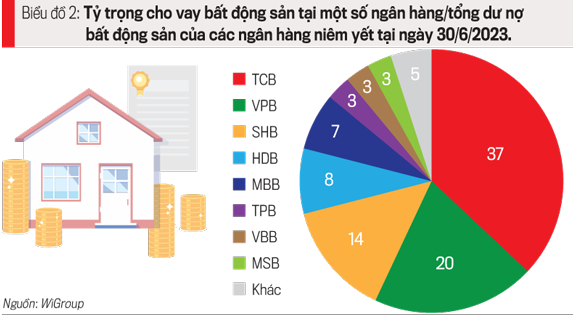

WiGroup’s statistics show that, by the end of the second quarter of 2023, the outstanding real estate loans of listed banks reached VND 411,659 billion (up 23% over the same quarter). This is the highest loan balance in the past 5 years and credit growth in this sector is also higher than in other sectors.

As noted, there is a concentration of credit for the real estate sector at a number of credit institutions, with a high growth rate; Some credit institutions also provide large credit to certain groups of customers.

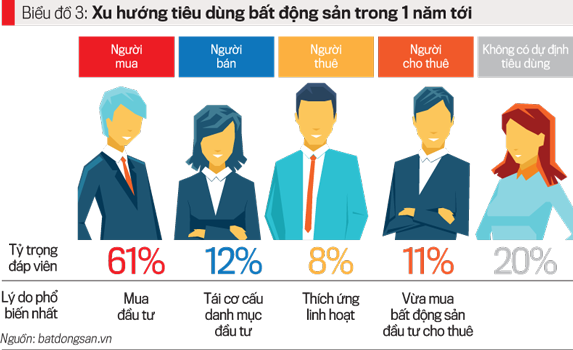

Although statistics show that real estate consumer credit is directed towards real needs and is assessed as less of a risk than business purposes, there is a potential risk that customers declare the purpose to serve their home buying needs. for living but the essence is for business investment. This is shown by the survey results of Real Estate Consumption Trends that Batdongsan.com.vn announced in early July 2023: 61% of buyers buy for investment purposes.

In addition to bad debt risk, real estate credit also creates a burden of term risk on the balance sheets of banks. According to statistics of the State Bank, 94% of real estate loans have a period of 10-25 years. Meanwhile, 80% of the mobilized capital of the banking system is short-term deposits with interest rates that vary according to the market…